- #Moneysoft payroll manager crack file upgrade#

- #Moneysoft payroll manager crack file full#

- #Moneysoft payroll manager crack file software#

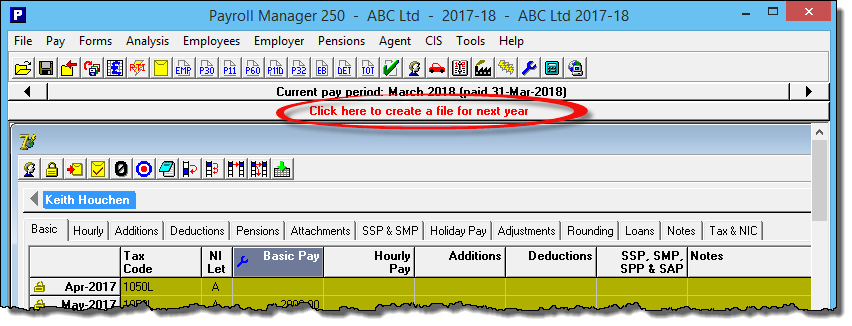

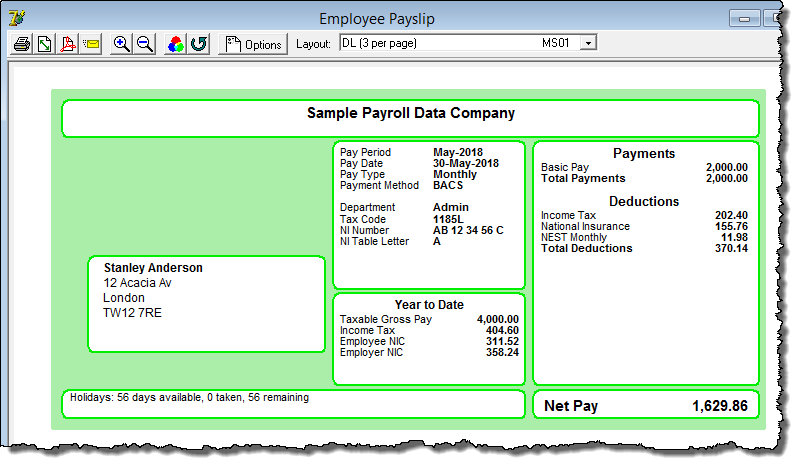

You can do anything from calculating salaries to payslips, sending RTI to HMRC and managing your employees with a calendar.

#Moneysoft payroll manager crack file software#

While they are more expensive at £99 per year, you can have an unlimited number of employees, and it offers a comprehensive software package. On the other side of the scale, for a large business, you might want to opt for BrightPay.

#Moneysoft payroll manager crack file upgrade#

However, you are then limited to this package when you want to expand, which could mean needing to upgrade and potentially disrupting your process. This can be excellent value for money when you only have a few employees to manage. SageOne, for instance, can cost as little as £3 per month with the capacity to manage up to 5 employees. If you are a smaller business, pricing might be the most critical point that you need to take into consideration. SoftwareĬhoosing the right software to use for your payroll often depends on several different factors, which might include: Now that you know what payroll means, as well as the different options available to you, let’s find out more about the kinds of costs that you can expect.

#Moneysoft payroll manager crack file full#

This can be less expensive than outsourcing payroll entirely, but it does mean that you have to take full responsibility to stay up to date with changing regulations.

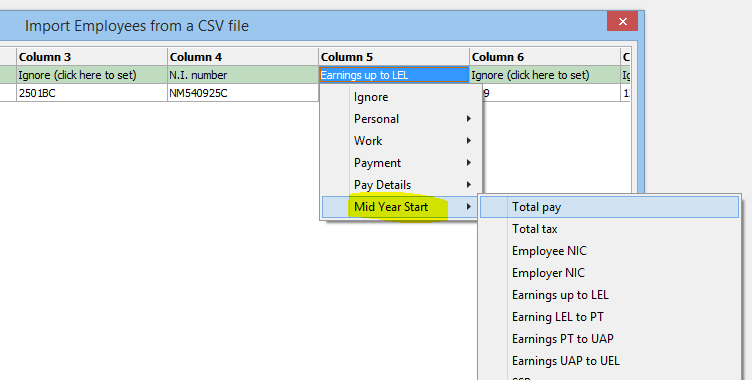

Payroll software takes some of the administrative burdens away, as sometimes you can set up auto enrolments, have payslips sent out regularly with minimal input and send information to HMRC automatically. If you want to keep complete control over your payroll, you might want to invest in payroll software. Usually, this will mean that your payroll company will deal with things like BACs and enrolment, while you deal with your gross to net calculations, for example.

When you decide to have your payroll partly managed, it means that you outsource most of your day-to-day obligations while maintaining a level of control. This includes keeping track of salaries, sending out payslips, submitting information to HMRC and often doing your end of year accounts.

When you opt to outsource your payroll fully, this means that a company will take over every aspect of your payroll. Mainly, there are three types of payroll services. What are the different types of payroll services? You also need to send real-time information to HMRC whenever you run your payroll, which helps you to stay compliant and working within the law. Payroll refers to the process of keeping a list of your employees, tracking how much they need to be paid as well as anything like holidays or sick days.Įach employee will require a payslip whenever they are paid, which is typically either weekly or monthly. Top 5 Payroll Companies for Contractorsįirst of all, let’s quickly take a look at what payroll is.Top 5 Payroll Companies for Accountants.Top 5 Payroll Companies for Large Companies.What are the different types of payroll services?.

0 kommentar(er)

0 kommentar(er)